Lorem Ipsum has been the industry's standard dummy text ever since the 1500s. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s.

more

friendly₹44,000 Crore Worth Car Stocks Piled Up

Cars not selling, Aache din for

- 2022 - The automotive industry in India is the world's ⦁ fourth-largest by production and valuation worth more than USD100 billion and accounts for 8% of the country's total exports and 7.1% of India's GDP

- Come 2023, India is the 3rd largest automobile market in the world in terms of sales.

- According to the 2021 ⦁ National Family Health Survey, barely 8% of Indian households own an automobile. According to government statistics, India has barely 22 automobiles per 1,000 people.

- India's major automobile manufacturing companies include ⦁ Maruti Suzuki, ⦁ Hyundai Motor India, ⦁ Tata Motors, ⦁ Ashok Leyland, ⦁ Mahindra ⦁ &⦁ Mahindra, ⦁ Force Motors, ⦁ Tractors and Farm Equipment Limited, ⦁ Eicher Motors, ⦁ Royal Enfield, ⦁ Sonalika Tractors, ⦁ Hindustan Motors, Hradyesh, ⦁ ICML, ⦁ Kerala Automobiles Limited, ⦁ Reva, ⦁ JSW MG Motor India, ⦁ Premier, ⦁ Tara International and ⦁ Vehicle Factory Jabalpur.

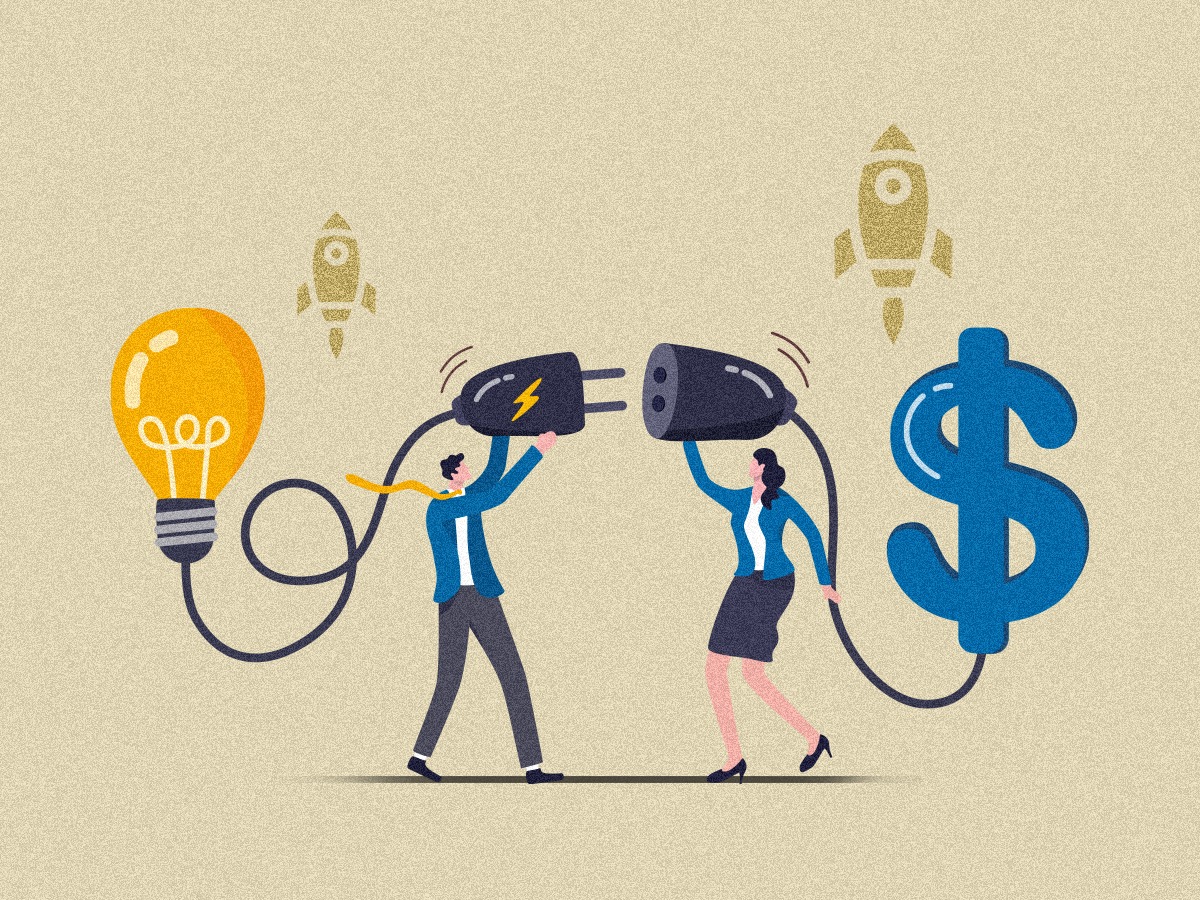

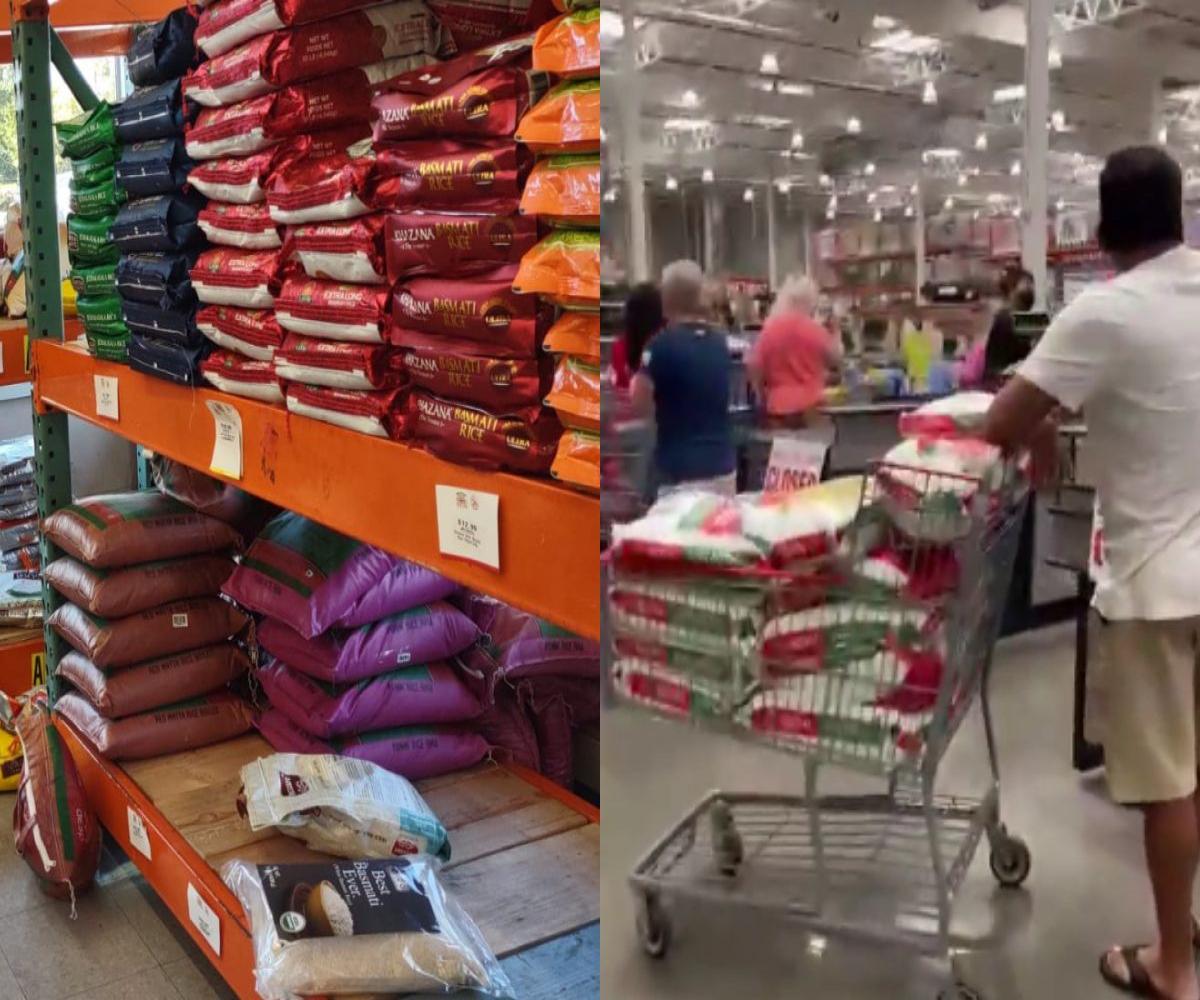

- With the constant changes in the market, the automobile manufacturers can expect a record inventory of 400,000 vehicles which is valued at ₹44,000 crore in May.

- With car shipments to dealers surpassing demand, registrations of passenger vehicles, an indicator of retail sales, are projected to decline by 5% in May compared to the same period last year.

- One of the reasons behind this scarcity in the demand of the cars is the increasing temperature due to heat waves coupled with election-related uncertainties.

- Pre-Covid stocks for the industry used to be in the range of 45 days. This has dropped to 2-3 weeks after the pandemic. Industry stocks are high. Forecast for monsoons is good. Interest rates are expected to come down later in the year, with inflation under control. Given the high base for the entire year, sales growth is likely to be in low single digits,’ said Hardeep Singh Brar, national sales head at Kia India.

- Myriad issues have resulted in this omen combining factors like lower economic growth, lower flow of financing for vehicles purchase, high energy costs and, in the international context, the continued shortage of components that directly impacts the production and inventory of vehicles at dealerships, both in local and international markets.

- In 2022, sales of new cars in Spain fell to 73,927 units, partly due to problems transporting cars to dealers.

- In 2022, the final sales figure remains at 813,396 units, 5.3% lower than 2021 and far from the forecast of 820,000 vehicles. In addition to all of this, we must bear in mind the persistent bottlenecks in the supply of vehicles, which has greatly conditioned the activity of dealers.

- The high inventory levels can also bring in its wake discounts and special schemes in June. In fact, executives said they might rise by 15-20% in June compared to May.

Due to less demand, more than 400,000 of automobile units which roughly worth ₹44,000 crore is stuck in the warehouses due to less demand in the market.

Sector Capsule:

Sector hits:

Editor’s note:

The government is working to eliminate this problem soon. Otherwise, one of the strongest economy pillars of the country might run into issue.

Keywords:

#automobilesindustry #industrysetbacks #autostock

West Bengal

Violence ensues post panchayati

00:37 Read

more

Kerala

I see red, red... oh red!

00:30 Read

more

Delhi

Can we please pause politics now?

00:38 Read

more

Karnataka

IAS : Public or Politician "servants"

00:52 Read

more

Maharashtra

Cash games : the need for more money

00:41 Read

more

Manipur

Your internet, your problem.

00:33 Read

more

Tamil Nadu

Slowly cooking to extract truth justice

00:44 Read

more

Janmu and Kashmir

Protection of country or abuse of power?

00:45 Read

more

The Burning Train : part 2?

00:32 Read

more

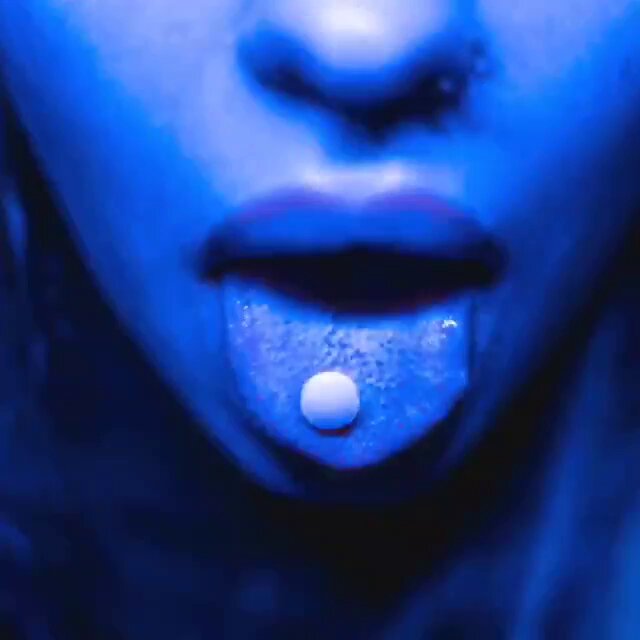

The battle against drugs for brighter future

00:49 Read

more

A breath of fresh air or fad

00:33 Read

more

When danger looms at the doorsteps

00:39 Read

more

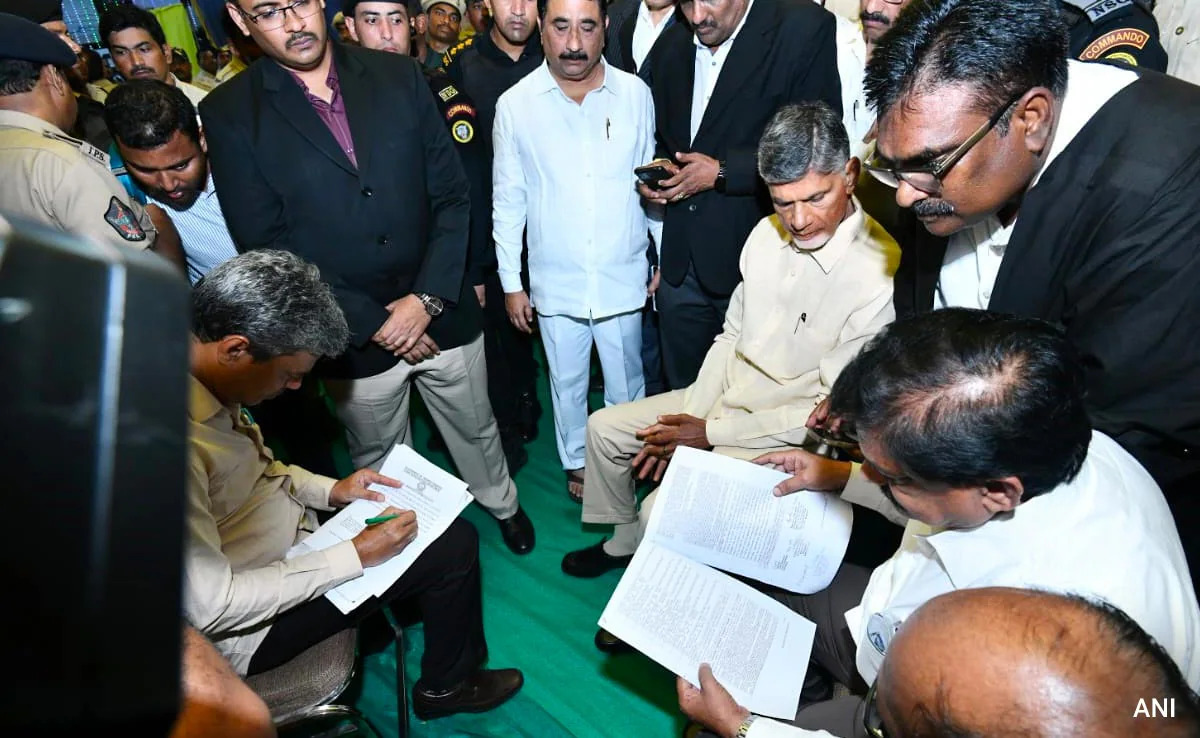

A new wave in Indian Politics

00:34 Read

more

A curse disguised as a blessing?

00:37 Read

more

The strengthening of friendships

00:37 Read

more

Have the sleepless nights come early?

00:42 Read

more