Social media influencer FoodPharma (Revant Himatsingka) raises voice against major brown bread manufacturing companies in India.

corpses?GST Valuation:Backbone or Bane

- All taxes, duties, fees, cesses and charges except GST CGST and IGST including VAT, excise and municipal tax if it is charged or recovered from the recipient and buyer as applicable. Example: Tobacco sector is subjected to both GST and excise.

- Any amount paid by the recipient for the supply which is liable to be paid by the supplier. A supplier may need to incur certain expenses in relation to supply however if these expenses are directly paid by the recipient, then such expenses also need to be included. Example: Apple Inc. the original equipment manufacturer, manufactures iPhone in its own facility and it gets a component manufacturer or supplier (recipient.) In the process, the component manufacturer sources accessories but Apple Inc got the accessories free which was the responsibility of the recipient. If contract says Apple Inc was liable to source the accessories, then this cost in not included in the value of supply. Supplier committed to the recipient that goods will reach on FOR basis including transportation then it becomes a composite supply and principal supply tax rate included.

- Incidental expenses or expenses incurred with main supply denotes to any amount charged by supplier for anything done by him for the supply of goods including commission, inspection, packing and freight charges. Example: While delivering LED television, if the supplier undertakes charges for special packing loading, commissioning expense or any additional cost for customization then this will be part of value of supply.

- Deferred payment incorporates interest, late fee or any penalty incurred for delayed payment.

- Subsidies are directly linked to price except the ones received from Centre/State government.Example: If you sell books at INR 5 and NGO promotes book sale says sell book at INR 3 adding that the INR 2 loss is paid by NGO. Value after considering, If the subsidy is already less as compared to value after consideration and received as government subsidy then it requires no further treatment.

- Special Circular UPI transaction is not liable for any charges by bankers as per Government rule.

- Discount includes an amount if you pay preown supply discount which is to be deducted from value of supply and if it is shown on invoice. Post supply discount can be lesser from value of supply based on the following: - Discount decided at the time of supply while making the agreement - Invoice of sale - Proportionate ITC reversed - No claim bonus (NCB) - Delcrede Agent Transaction (Schedule 1 transaction)/independent credit facility exempts tax.

- Rule 27 relates to payment received in the form of barter, part payment in kind or discounts Example: A sells furniture to B at INR 50,000 plus Firstly the open market value of the laptop is decided, if it is unavailable then monetary value is determined. The composite value is equivalent to the consideration money combined with the known money value.

- Rule 28 pertains to exchange amongst related people like partner, family member and dependents or two distinct people operating with same PAN. If principal has appointed sole distributor/agent then it is applicable.

- Rule 29 is relevant to the value of supply of goods between the principal and his agent which will be the open market value of the goods being supplied, or at the option of the supplier, be 90% of the price charged for the supply of goods of like kind and quality by the recipient to his customer not being a related person.

- Rule 31(A) comprises of value in relation to lottery, betting, gambling and horse racing. Face value and price notified by government amounts to value of supply.

- Rule 32 (value of supply is determined based on these 5 services): - Rule 32A - Purchase sale of foreign currency where one of the currencies exchanged is INR and RBI reference rate is available. If RBI is unavailable and none of the exchanges is INR, then both the currencies to be converted to INR and which is lower and 1% of that value becomes value of supply. - Rule 32B applies to transaction as per the following norms INR value is till INR1 lakh 1% of the amount or 250 whichever is higher becomes value of supply INR value is over 1 lakh but not above 10 lakh, .5% applicable for each amount above 1 lakh INR value is above 10 lakh then 1.1% is applicable

- Rule 33 is referred to pure agent. If supplier is appointed and he spends on your behalf taking actual reimbursement from you, then whether it is included in value of supply. Example: Hotel/travel/telephone expenses which are reimbursed on actual basis then it is included in value of supply.

How do we calculate tax? How do we know when GST is applicable? Rather exactly what point of supply is GST applicable? And most importantly at what value is GST levied? While nation is struggling to decipher. In India, the monthly gross GST collections crossed a mammoth INR 2 lakh crore as per the Finance Ministry data.

Supplier and the recipient are not related and price is the sole consideration:

Supplier and the recipient are related and price is not sole consideration:

Notified Services

Editor’s Note

GST in India have driven businesses to restructure and model their supply chain and systems owing to multiplicity of taxes and costs involved. With hopes that GST will undergo further reforms while the way India does business will change, forever.

Keywords

#tax #gst #sector15

West Bengal

Violence ensues post panchayati

00:37 Read

more

Kerala

I see red, red... oh red!

00:30 Read

more

Delhi

Can we please pause politics now?

00:38 Read

more

Karnataka

IAS : Public or Politician "servants"

00:52 Read

more

Maharashtra

Cash games : the need for more money

00:41 Read

more

Manipur

Your internet, your problem.

00:33 Read

more

Tamil Nadu

Slowly cooking to extract truth justice

00:44 Read

more

Janmu and Kashmir

Protection of country or abuse of power?

00:45 Read

more

The Burning Train : part 2?

00:32 Read

more

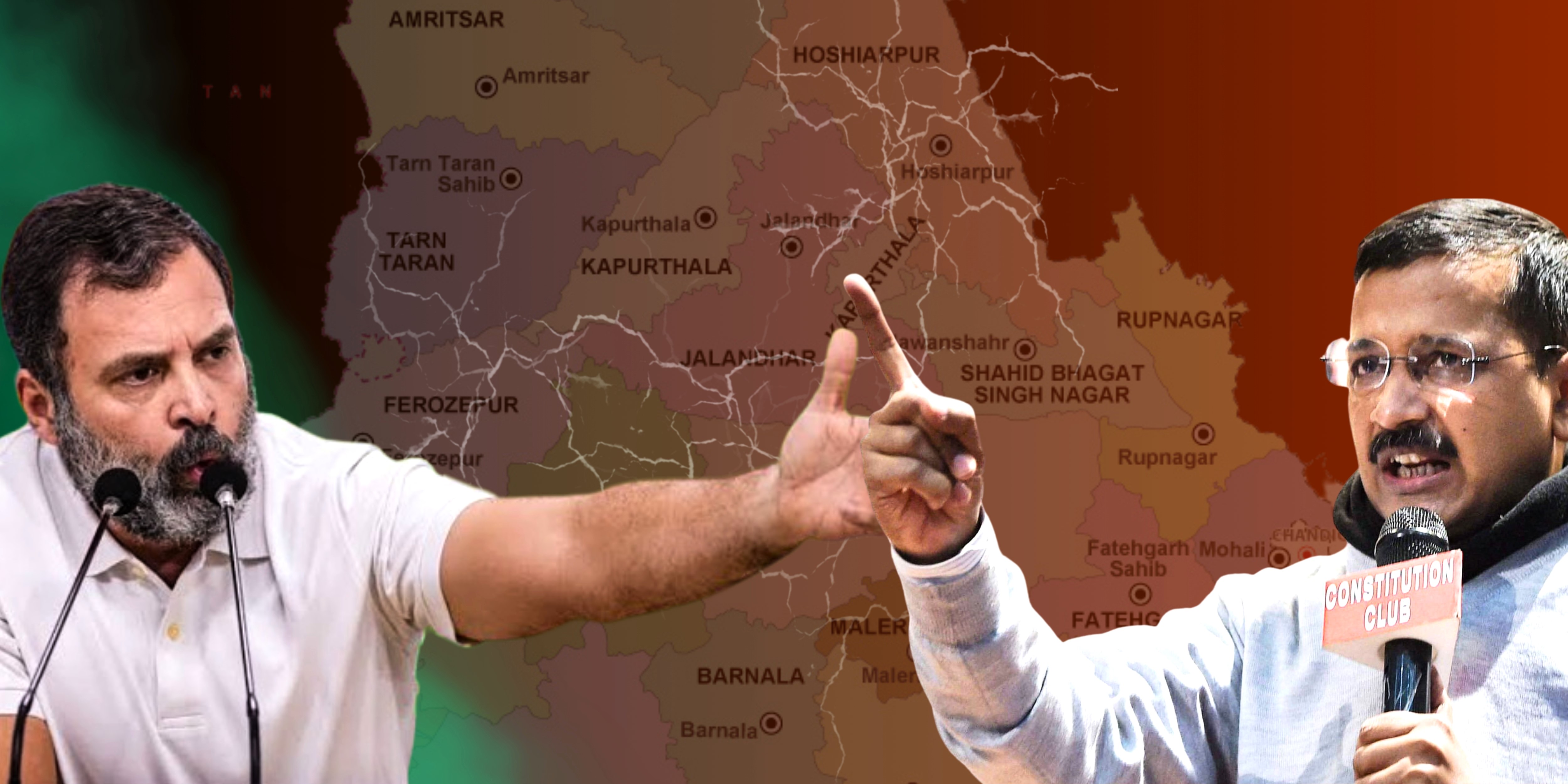

The battle against drugs for brighter future

00:49 Read

more

A breath of fresh air or fad

00:33 Read

more

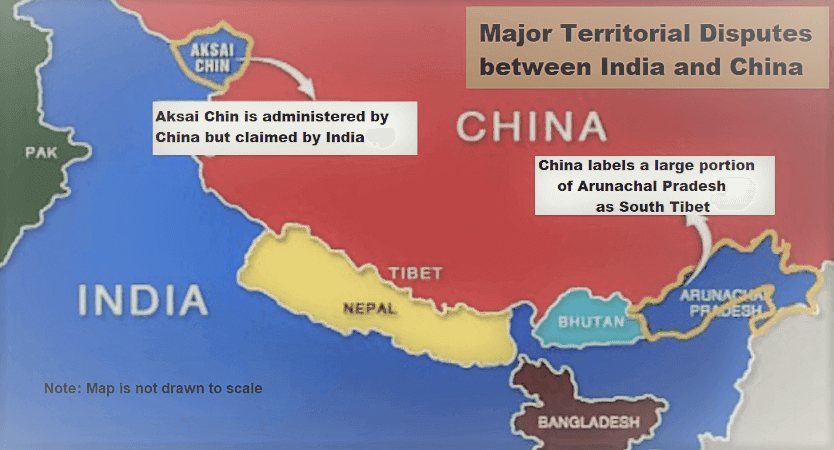

When danger looms at the doorsteps

00:39 Read

more

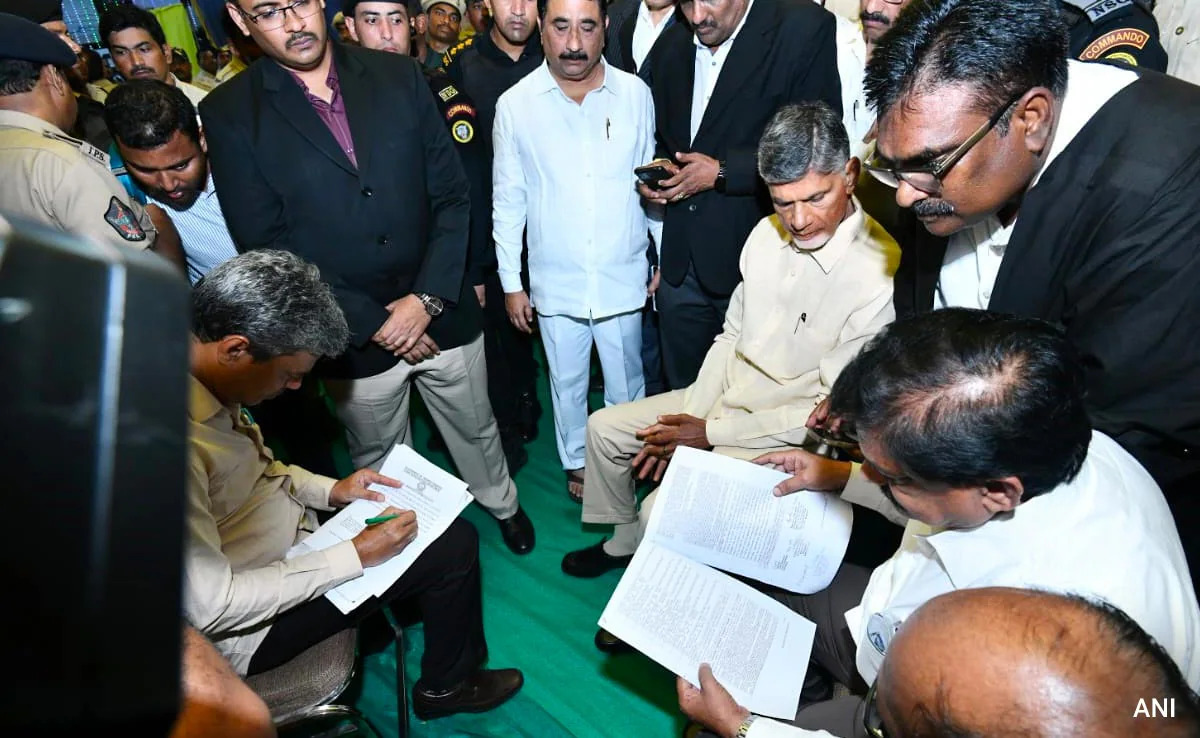

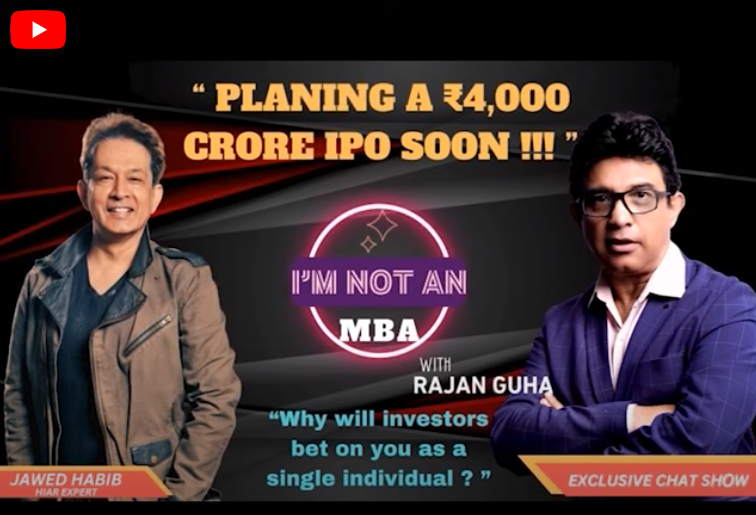

A new wave in Indian Politics

00:34 Read

more

A curse disguised as a blessing?

00:37 Read

more

The strengthening of friendships

00:37 Read

more

Have the sleepless nights come early?

00:42 Read

more

BROADCAST CHANNELS

DAILY NEWS PORTALS

Copyright © 2025 All Rights Reserved by TRUEE.NEWS is a copyright property of Independent Media Corp